Standard Chartered Bank is Hiring – 2025 | SCB Career – The CV Guy: MNC Jobs bd

If you’re seeking new opportunities in the banking sector, Standard Chartered Bank (SCB), one of the most reputable multinational banks operating in Bangladesh, is currently hiring for several key roles in Dhaka. These openings are a chance to grow your career with a global brand that’s known for its professional culture, leadership development, and innovation in financial services.

If you’re ready to make a move in your banking career, this is your moment!

1. Branch Manager – Banani Branch

Department: Retail Banking

Location: Banani, Dhaka

Application Deadline: 09 June 2025

Understood. Here’s your original content formatted for WordPress, with no edits to the wording — only proper formatting using headings, subheadings, and lists to improve readability and structure within a blog post editor:

JOB SUMMARY

To position the branch as an effective retail sales and service outlet by providing excellent client service for increasing the client base and achieving the branch asset & liability targets for Premium Clients segment.

Assist the Branch Manager/ Branch Operating Service Manager to ensure that all the Group & Local Regulatory guidelines are adhered to during branch operations.

RESPONSIBILITIES

Following key responsibilities are to be carried out for the branch:

Financial/Sales:

- To achieve targets in terms of building assets and liabilities set forth in Job Objective

- To capitalize on crosssell opportunities

- To communicate with customers and potential customers for sales opportunities

- To help and organize sales promotions (presentations, seminars, exhibitions etc) in coordination with other BM & sale channels

Service Quality:

- To provide high quality service to all segments’ clients

- To achieve set targets in terms of service standards for customer transactions

Human Resources:

- Have open channels of communication & maintain high levels of motivation among staff

- Organize training for staff based on training gaps & handle career planning & professional performance management

Operational Risk/Administration:

- Create and maintain a compliance culture through maintenance of the Operational Risk Framework (ORF) in the branch

- Coordinate and assist regulatory and other audits

- Timely submission of accurate compliance and risk reports

- Surprise checking of Maintenance operations and subsequent destruction of security items e.g. undelivered card, Cheque Books etc

- Maintenance and subsequent destruction of security items e.g. undelivered credit card, retained credit card etc

- Request for authorization for card cheque processing

- To be responsible for the branch security management and coordinating with Administration as and when required

- To meet transaction processing standards, ensure good cash management and overall branch operations and other services provided from branch

- Ensure strict compliance on the process & policy of Group guidance & Local Regulatory, such as AntiMoney Laundering, Sanction, Customer Due Diligence, Code of Conduct etc

- To ensure that branch maintain all the records that are auditable for good audit rating

- To ensure locker and student file service is provided as per approved process

- To ensure compliance with Group & local directives for preventing Money Laundering

- To ensure the awareness of business continuity plan among the department and perform the role of DCC for the assigned department coordinating with Country Business Continuity Manager

- To act as BAMLCO and liaise with CAMLCO and Legal Advisor for MLP related issue, such as perform half yearly AML Self Assessment, AML quarterly meeting and other activities as mentioned in BFIU circular 19. Suspicious Activity Reporting etc

- Ensure correct regulatory reporting, as applicable

- To act as a one of Bangladesh Bank signatory based on Power of attorney empowered by CEO Bangladesh

- Oversee and Approve Cash activities as detailed in DOA & Teller Transaction Policy

Health & Safety:

- To be responsible for managing and reporting the health and safety issues within the branch and coordinating with Country Heath & Safety Manger

- To ensure that branch staffs are adequately trained and supervised on H\&S issues

- To ensure that employees are free to raise H\&S issues and that these issues are addressed accordingly

Regulatory & Business Conduct

- Display exemplary conduct and live by the Group’s Values and Code of Conduct

- Take personal responsibility for embedding the highest standards of ethics, including regulatory and business conduct, across Standard Chartered Bank. This includes understanding and ensuring compliance with, in letter and spirit, all applicable laws, regulations, guidelines and the Group Code of Conduct

- Lead to achieve the outcomes set out in the Bank’s Conduct Principles

- Effectively and collaboratively identify, escalate, mitigate and resolve risk, conduct and compliance matters

Key Stakeholders

- Head – Client Relationships

- Product Heads and Segment Heads

- Support Unit Departments

- Other BMs, RMs & BOSMs

- Account Services

- Loan Operations

- Assurance Manager

- Compliance, Legal and FCC

- Credit

- Securities Bonds Dept.

- Client Experience

- Existing and Prospective Clients

Our Ideal Candidate

- Minimum Bachelor’s degree

- Minimum 5 – 7 years of banking experience in relevant field

Role Specific Technical Competencies

- MS Office

About Standard Chartered

We’re an international bank, nimble enough to act, big enough for impact. For more than 170 years, we’ve worked to make a positive difference for our clients, communities, and each other. We question the status quo, love a challenge and enjoy finding new opportunities to grow and do better than before. If you’re looking for a career with purpose and you want to work for a bank making a difference, we want to hear from you. You can count on us to celebrate your unique talents and we can’t wait to see the talents you can bring us.

Our purpose, to drive commerce and prosperity through our unique diversity, together with our brand promise, to be here for good are achieved by how we each live our valued behaviours. When you work with us, you’ll see how we value difference and advocate inclusion.

Together we:

- Do the right thing and are assertive, challenge one another, and live with integrity, while putting the client at the heart of what we do

- Never settle, continuously striving to improve and innovate, keeping things simple and learning from doing well, and not so well

- Are better together, we can be ourselves, be inclusive, see more good in others, and work collectively to build for the long term

What We Offer

In line with our Fair Pay Charter, we offer a competitive salary and benefits to support your mental, physical, financial and social wellbeing.

- Core bank funding for retirement savings, medical and life insurance, with flexible and voluntary benefits available in some locations

- Time-off including annual leave, parental/maternity (20 weeks), sabbatical (12 months maximum) and volunteering leave (3 days), along with minimum global standards for annual and public holiday, which is combined to 30 days minimum

- Flexible working options based around home and office locations, with flexible working patterns

- Proactive wellbeing support through Unmind, a market-leading digital wellbeing platform, development courses for resilience and other human skills, global Employee Assistance Programme, sick leave, mental health first-aiders and all sorts of self-help toolkits

- A continuous learning culture to support your growth, with opportunities to reskill and upskill and access to physical, virtual and digital learning

- Being part of an inclusive and values driven organisation, one that embraces and celebrates our unique diversity, across our teams, business functions and geographies – everyone feels respected and can realise their full potential

2. Officer – Trade Operations, Export

Department: Retail Banking / Operations

Location: Dhaka

Deadline to Apply: 09 June 2025

RESPONSIBILITIES

Strategy

To assist the Line Manager in managing and overseeing the day-to-day Core Operations Team with the aim to achieve:

- Operational standards / compliance

- Increased productivity and efficiency

- Good cost control within the Team

- Good quality control on operational / transactional risks

Additional duties:

- Drive and monitor initiatives and activities to improve daily operations in view of accuracy, efficiency, and services

- Work closely with Trade Product Operations and Processing Operations to standardize, simplify, improve and streamline process to strive for continuous productivity improvement

- Work closely with Trade Client Operations Team to continuously drive Client experience improvements

- Work with Trade BRM to proactively manage all compliance and operational risk at unit level; effectively implement all operational, regulatory, and financial controls with daily controls, periodic monitoring and timely issue handling

Processes

- Perform daily operations according to the laid down procedure and standard of service

- Ensure operations comply with applicable:

- Generic Product Program and Country Product Addendum

- Money Laundering Prevention Procedures and report any suspicious activity to the Unit Money Laundering Prevention Officer and Line Manager

- Sanctions policy & procedures

- Group Policies / GDOI

- Legal & Compliance Policies

- Assist Line Manager in collaborating with Technology on futuristic digital opportunities, pre-empt disruptive forces, and commercialize innovative use of technologies

- Assist Line Manager to achieve the financial performance targets of front-to-back operations

- Drive the respective country to prioritize investments into making the Client journey simpler, faster, better

- Question the status quo in driving bold conversations of doing business with Right Clients with a sustainable cost/income ratio

Governance & Risk Management

- Support effective implementation of all operational, regulatory, and financial control measures and monitoring plans for compliance and control standards per the Enterprise Risk Management Framework

- Assist in coordinating periodic business monitoring (self-assessment) activities within the business unit and escalate findings and/or breaches to Business Unit Head and BRM

- Proactively communicate operational risk issues to the Business Unit Head and BRM

- Escalate significant events appropriately

- Support operations team pre/post audits and assurance reviews

- Provide support on regular and ad hoc tasks related to unit operational risk management as assigned by BRM

- Embed the Group’s values and code of conduct

- Develop a robust culture of adherence to ethics, compliance, and regulatory standards among employees

Regulatory & Business Conduct

- Display exemplary conduct and live by the Group’s Values and Code of Conduct

- Take personal responsibility for embedding the highest standards of ethics and regulatory conduct across Standard Chartered Bank

- Work toward achieving outcomes set out in the Bank’s Conduct Principles:

- Fair Outcomes for Clients

- Effective Financial Markets

- Financial Crime Compliance

- The Right Environment

- Effectively and collaboratively identify, escalate, mitigate, and resolve risk, conduct, and compliance matters

- Monitor effective communication and implementation of regulatory changes

Key Stakeholders

Internal:

- Head & Team members of Trade Operations

- Trade BRM

- Group Trade Product and Client Operations

- Local TB Product Management

- Business Technology

- Front Office & Middle Office

- Other Operations Functions

- Other Functions (HR, Finance, Legal & Compliance, Tax)

- Audit and investigations

External:

- Customers

- Vendors

- External consultants

- Bank Audit / Accounting firms

- Local and Regional Regulators

Qualification

Background:

- Education: University Graduate or above

- Experience: Minimum 1 year of Operations working experience

Professional Skills

- In-depth understanding of various types of trade products, process flow, regulations, and accounting rules

- Strong analytical, problem-solving, and operational skills

- Good management skills and ability to coach the team to achieve agreed targets

Soft Skills

- Sound PC / MS Office skills

- Strong organizational skills and well-developed business acumen

- Good interpersonal and communication skills

- Self-motivated, able to manage multiple tasks and perform under pressure

Other Preference

- Passion for identifying and driving new operations improvement opportunities

- Job holders are expected to follow other duties as assigned by the Line Manager from time to time

Role Specific Technical Competencies

- Business Facilitation

- Business Partnering

- Process Management

- Manage Change

- Service Delivery and Operations

- Products + Processes

- Business Governance and Support

About Standard Chartered

We’re an international bank, nimble enough to act, big enough for impact. For more than 170 years, we’ve worked to make a positive difference for our clients, communities, and each other. We question the status quo, love a challenge and enjoy finding new opportunities to grow and do better than before.

If you’re looking for a career with purpose and want to work for a bank making a difference, we want to hear from you. You can count on us to celebrate your unique talents and we can’t wait to see the talents you can bring us.

Our purpose, to drive commerce and prosperity through our unique diversity, together with our brand promise, to be here for good, is achieved by how we each live our valued behaviours. When you work with us, you’ll see how we value difference and advocate inclusion.

Together We:

- Do the right thing – act with integrity and put the client at the heart of what we do

- Never settle – continuously strive to improve and innovate

- Are better together – be inclusive, collaborative, and build for the long term

What We Offer

In line with our Fair Pay Charter, we offer a competitive salary and benefits to support your mental, physical, financial, and social wellbeing.

- Core bank funding for retirement savings, medical, and life insurance

- Flexible and voluntary benefits (in some locations)

- Time-off including:

- Annual leave

- Parental/maternity leave (20 weeks)

- Sabbatical (up to 12 months)

- Volunteering leave (3 days)

- Combined minimum 30 days of annual and public holidays globally

- Flexible working options (home/office-based)

- Proactive wellbeing support through:

- Unmind (digital wellbeing platform)

- Development courses for resilience and human skills

- Global Employee Assistance Programme

- Mental health first-aiders

- Self-help toolkits

- A continuous learning culture with opportunities to reskill, upskill, and access to physical, virtual, and digital learning

- An inclusive, values-driven organization that embraces diversity across teams, functions, and geographies

3. Head – CRES (Corporate Real Estate Services)

Department: Business Support & Management

Location: Dhaka

Deadline to Apply: 04 June 2025

Below is your original text properly formatted for a WordPress blog post using semantic headings (h2, h3), bullet points, and spacing for readability — without changing any wording. You can copy and paste this directly into the WordPress block or classic editor for optimal structure and presentation.

Job Summary

As the Country Head, Corporate Real Estate Services (CRES), will be accountable for managing SC Bank’s real estate, including the health and safety, security and Sustainability aspects. The role will be accountable for driving the end-to-end strategic approach to the country’s CRES portfolio. The scope includes the physical environment for customers and staff and by its nature impacts every member of the Bank staff world-wide. The role is also accountable for all projects in relation to the properties; Security, Health & Safety, Sustainability; and Supply Partner Management. This role is the risk control owner in keeping the Bank safe through the provision of a safe, secure and healthy environment for our staff and customers.

The Country Head, CRES will have responsibility for developing and executing a cost-effective and sustainable real estate, workplace and Sustainability strategy that can be leveraged across the bank’s global footprint of owned and leased corporate offices, branches, data centres, cash vaults, BCP sites and ATMs. S/he will work with the Business Divisions/Functions to understand demand and execute value added and cost-effective real estate transactions. The Country Head, CRES will lead a team of real estate professionals, partner with large scale vendors and preferred suppliers, and engage with senior leadership in country to effectively meet Standard Chartered’s corporate real estate requirements. As such this leader will bring in progressive and forward-thinking mindset to work closely Strategy & Talent Team and Technology teams on all corporate real estate solutions.

Key Responsibilities

Strategy

- Accountable for the development and execution of the Country CRES Corporate Plan including the delivery of the CRES scorecard objectives and outcomes aligned to strategic goals of to dial up both clients and colleagues experience by transforming office portfolio and branch portfolio as well as elevating our brand pivot to affluent and cross border. Drive Net Zero footprint across our real estate portfolio and enable our partners and teams to deliver everyday to serve our colleagues, businesses and clients.

- Accountable for the development and delivery of the Bangladesh CRES strategy, influencing key geographic and business stakeholders to ensure optimal solutions are implemented.

- Effectively communicate the vision and strategy to ensure it is well understood by the Supply Partner Teams who help delivery everyday for our colleagues and clients.

Business

- The role is accountable to ensure all aspects of the CRES function are well managed, well operated and provide safe and productive work environment for the group’s staff and customers.

- Accountable for the CRES engagement model with country CEO and business leaders, to ensure the function has a deep understanding of strategic business needs and influence business outcomes beyond express needs.

- Accountable for managing a portfolio of ~200 K Sq. ft., spread mainly across branch and office space, supporting SCB staff and clients across Bangladesh.

- Manage operating budget around ~$9m, through geographic teams in the most effective and efficient manner in support of and aligned with the business strategy, through continually improving operating metrics relating to space use, costs and employee experience.

Processes

- Ensure all aspects of the CRES function are well managed, well operated and provide a productive and safe environment for staff and customers.

- Drive the optimisation of our workplace through the specialist CRES groups of Asset Management, Project Management, Safety & Security and Facilities Management.

- Ensure appropriate levels of personal and protective security across our business, functions and operations to protect our staff, customers and physical assets.

- Accountable for the Bangladesh CRES resourcing / budget decisions.

- Develop, implement and deliver CRES strategies and strategic initiatives.

- Manage annual country CRES budgets including capital projects budgets. Agree budgets with key stakeholders.

- Lead and empower teams to ensure the country meets its respective agreed environmental targets.

People & Talent

- Lead, inspire and motivate the CRES team ensuring that each individual achieves their potential and that the team delivers its collective agenda.

- Lead through example and build the appropriate culture and values. Set appropriate tone and expectations from their team and work in collaboration with risk and control partners.

- Ensure the provision of ongoing training and development of people and ensure that holders of all critical functions are suitably skilled and qualified for their roles ensuring that they have effective supervision in place to mitigate any risks.

- Employ, engage and retain high quality people, with succession planning for critical role, build bench strength and formulate succession plans for the team.

- Review the team structure/capacity plans regularly and feed opportunities into CRES Target Operating Model refresh.

- Support the SCB promise through the active support for team CSR activities.

Risk Management

As Risk Control Owner for CRES Management and Security Management (including H&S regulations) in Region, responsible under the Group Operational Risk Framework (ORF) for ensuring that the residual risks within the scope of CRES responsibilities remain within appetite. In discharging this responsibility, the Country Head must:

- Ensure risk control for all CRES related risks, including Health and Safety, Security and Business Continuity Management.

- Responsible for ensuring that the residual risks within the scope of responsibilities for managing the risk control areas of CRES remain within appetite at Country.

- Act as a liaison between the Country Management Team and CRES for country Crisis Management.

- Challenge and verify First Line risk identification and assessments, in line with changes in the internal and external environment.

- Identify and report key risks and ensure where outside of the risk appetite they are escalated to the appropriate body for risk acceptance.

- Maintain a good understanding of applicable laws and regulations pertaining to CRES Risk control areas.

- Monitor compliance with and effectiveness of the risk control environment.

- Monitor ‘live’ risk issues and events material to the Bank and verify whether appropriate management action is being taken to mitigate their impact.

- Advise governance bodies on key risks, the effectiveness of mitigants and controls, and alignment of residual risks with appetite.

- Ensure operations in region / country are audit ready.

Governance

- Act as second line of assurance underpinning Partners responsibilities.

- Represent CRES in risk committees.

- Chair Country Financial Operational Risk Team Meetings (FORTM) every two months when appropriate.

- Accountable to ensure Supply Partner governance standards are met and performance of supply partners is meeting agreed service level standards.

Regulatory & Business Conduct

- Display exemplary conduct and live by the Group’s Values and Code of Conduct.

- Take personal responsibility for embedding the highest standards of ethics, including regulatory and business conduct, across Standard Chartered Bank. This includes understanding and ensuring compliance with, in letter and spirit, all applicable laws, regulations, guidelines and the Group Code of Conduct.

- Lead the CRES team to achieve the outcomes set out in the Bank’s Conduct Principles: Fair Outcomes for Clients; Effective Financial Markets; Financial Crime Compliance; The Right Environment.

- Effectively and collaboratively identify, escalate, mitigate and resolve risk, conduct and compliance matters.

- Monitor local regulatory developments and establish local addenda to CRES owned Policies and Standards as required.

Key Stakeholders

- Accountable for senior stakeholder management; developing strong partnerships, proactive discovery of upcoming projects that impact the Country spend, while creating value by influencing stakeholders to make decisions when considering the wider business.

- Key stakeholder interactions including Bangladesh CEO, CFOs, COO’s, CIOs and Business/Function Heads.

- CRES Leadership Team.

- Country Strategy & Talent Team.

Other Responsibilities

Embed Here for good and Group’s brand and values in Bangladesh CRES; Perform other responsibilities assigned under Group, Country, Business or Functional policies and procedures;

Skills and Experience

- Influencing Through Expertise

- Effective Communications

- Business Intelligence

- Budget Management

- Risk Management

- Supply Partner Management

- Facilities Management

Qualifications

- Master of Business Studies Majoring Management

- Knowledge (preferably with certifications) of the facilities/real estate market as well as a keen understanding of customer service principles

- Current Corporate Real Estate Senior position with 12+ years of experience preferably across Banks in Bangladesh

Training

- Demonstrated resourcefulness in seeking out market opportunities and leveraging supplier base to maximum advantage

- Exceptional leadership capabilities and experience managing large multi-disciplinary teams

- Strong Communication and Negotiation skills

Licenses

(Not specified)

Membership

- CoreNet (optional)

- RICS (optional)

Certifications

- Facilities & Real Estate Management (preferable)

Languages

- English

- Bangla

About Standard Chartered

We’re an international bank, nimble enough to act, big enough for impact. For more than 170 years, we’ve worked to make a positive difference for our clients, communities, and each other. We question the status quo, love a challenge and enjoy finding new opportunities to grow and do better than before.

If you’re looking for a career with purpose and you want to work for a bank making a difference, we want to hear from you. You can count on us to celebrate your unique talents and we can’t wait to see the talents you can bring us.

Our purpose, to drive commerce and prosperity through our unique diversity, together with our brand promise, to be here for good are achieved by how we each live our valued behaviours. When you work with us, you’ll see how we value difference and advocate inclusion.

Together we:

- Do the right thing and are assertive, challenge one another, and live with integrity, while putting the client at the heart of what we do

- Never settle, continuously striving to improve and innovate, keeping things simple and learning from doing well, and not so well

- Are better together, we can be ourselves, be inclusive, see more good in others, and work collectively to build for the long term

What We Offer

In line with our Fair Pay Charter, we offer a competitive salary and benefits to support your mental, physical, financial and social wellbeing.

- Core bank funding for retirement savings, medical and life insurance, with flexible and voluntary benefits available in some locations

- Time-off including annual leave, parental/maternity (20 weeks), sabbatical (12 months maximum) and volunteering leave (3 days), along with minimum global standards for annual and public holiday, which is combined to 30 days minimum

- Flexible working options based around home and office locations, with flexible working patterns

- Proactive wellbeing support through Unmind, a market-leading digital wellbeing platform, development courses for resilience and other human skills, global Employee Assistance Programme, sick leave, mental health first-aiders and all sorts of self-help toolkits

- A continuous learning culture to support your growth, with opportunities to reskill and upskill and access to physical, virtual and digital learning

- Being part of an inclusive and values-driven organisation, one that embraces and celebrates our unique diversity, across our teams, business functions and geographies – everyone feels respected and can realise their full potential

4. Officer – POE, Cumilla

Department: Retail Banking

Location: Cumilla

Deadline to Apply: 05 June 2025

Here is your content properly formatted for a WordPress blog post using structured headings, subheadings, bullet points, and spacing for optimal readability and professional presentation. No wording has been changed — only the structure has been improved for blog display.

Job Summary

Strategy

To assist the Line Manager in managing and overseeing the day-to-day Core Operations Team with the aim to achieve:

- Operational standards / compliance

- Increased productivity and efficiency

- Good cost control within the Team

- Good quality control on operational / transactional risks

- Drive and monitor initiatives and activities to improve daily operations in view of accuracy, efficiency and services

- Work closely with Trade Product Operations and Processing Operations to standardize, simplify, improve and streamline processes for continuous productivity improvement

- Work closely with Trade Client Operations Team to continuously drive client experience improvements

- Work with Trade BRM to proactively manage all compliance and operational risk at the unit level; effectively implement all operational, regulatory, and financial controls through daily controls, periodic monitoring and timely issue handling

Processes

Perform daily operations according to laid down procedures and service standards and ensure compliance with applicable policies, including:

- Generic Product Program and Country Product Addendum

- Money Laundering Prevention Procedures (report suspicious activity to the Unit MLPO and Line Manager)

- Sanctions policy & procedures

- Group Policies / GDOI

- Legal & Compliance Policies

Other responsibilities:

- Assist Line Manager in collaborating with Technology on futuristic digital opportunities, pre-empt disruptive forces and commercialize innovative use of technologies

- Support achievement of financial performance targets for front-to-back operations

- Drive initiatives to make client journeys simpler, faster, and better

Governance & Risk Management

- Support effective implementation of all operational, regulatory, and financial control measures under the Enterprise Risk Management Framework

- Assist with periodic business monitoring (self-assessments) and escalate findings or breaches to the Business Unit Head and BRM

- Proactively communicate operational risk issues; escalate significant events as appropriate

- Support pre/post audit processes and assurance reviews

- Provide support for regular and ad hoc tasks assigned by BRM related to unit operational risk management

- Embed the Group’s values and Code of Conduct

- Foster a culture of high ethical standards and compliance across the team

Regulatory & Business Conduct

- Display exemplary conduct and live by the Group’s Values and Code of Conduct

- Take personal responsibility for upholding the highest ethical and regulatory standards across Standard Chartered Bank

- Ensure full compliance with all applicable laws, regulations, and internal codes

- Work toward achieving outcomes set in the Bank’s Conduct Principles:

- Fair Outcomes for Clients

- Effective Financial Markets

- Financial Crime Compliance

- The Right Environment

- Effectively identify, escalate, mitigate and resolve risk and compliance matters

- Monitor the effective communication and implementation of regulatory changes

Key Stakeholders

Internal

- Head & Team members of Trade Operations

- Trade BRM

- Group Trade Product and Client Operations

- Local TB Product Management

- Business Technology

- Front Office & Middle Office

- Other Operations Functions

- Other Functions (HR, Finance, Legal & Compliance, Tax)

- Audit and Investigations

External

- Customers

- Vendors

- External consultants

- Bank Audit / Accounting firms

- Local and Regional Regulators

Other Responsibilities

- Embed the “Here for good” ethos and the Group’s brand and values in the team

- Perform other responsibilities as assigned under Group, Country, Business, or Functional policies and procedures

Skills and Experience

- Business Facilitation

- Business Partnering

- Process Management

- Manage Change

- Service Delivery and Operations

- Products + Processes

- Business Governance and Support

Qualifications

Background

- Education: Minimum Bachelor’s degree from a reputed university

- Experience: Minimum 1 year of relevant operations experience

Professional Skills

- In-depth understanding of various types of trade products, process flows, regulations, and accounting rules

- Strong analytical, problem-solving, and operational skills

- Effective management skills with the ability to coach the team toward achieving targets

Soft Skills

- Proficiency in MS Office

- Strong organizational skills and developed business abilities

- Good interpersonal and communication skills

- Self-motivated and able to manage multiple tasks under pressure

Other Preference

- Passion for identifying and driving new operational improvement opportunities

- Willingness to take on additional duties and responsibilities as assigned by Line Manager

About Standard Chartered

We’re an international bank, nimble enough to act, big enough for impact. For more than 170 years, we’ve worked to make a positive difference for our clients, communities, and each other. We question the status quo, love a challenge and enjoy finding new opportunities to grow and do better than before.

If you’re looking for a career with purpose and want to work for a bank that makes a difference, we want to hear from you. You can count on us to celebrate your unique talents, and we can’t wait to see what you’ll bring to our team.

Our Purpose and Promise

Our purpose, to drive commerce and prosperity through our unique diversity, and our brand promise, to be here for good, are reflected in how we live our values every day. At Standard Chartered, we:

- Do the right thing – Act with integrity and put the client first

- Never settle – Continuously improve and innovate

- Are better together – Foster inclusion, value differences, and build for the long term

What We Offer

In line with our Fair Pay Charter, we provide competitive compensation and benefits to support your overall wellbeing:

- Retirement savings, medical and life insurance

- Flexible and voluntary benefits (available in some locations)

- Paid time-off including:

- Annual leave

- Parental/maternity leave (20 weeks)

- Sabbatical (up to 12 months)

- Volunteering leave (3 days)

- Global minimum of 30 days annual/public holiday combined

- Flexible working arrangements (home/office-based)

- Access to wellbeing tools like Unmind and the Global Employee Assistance Programme

- Training and development for professional and personal growth

- A diverse, respectful, and inclusive workplace where everyone feels they belong

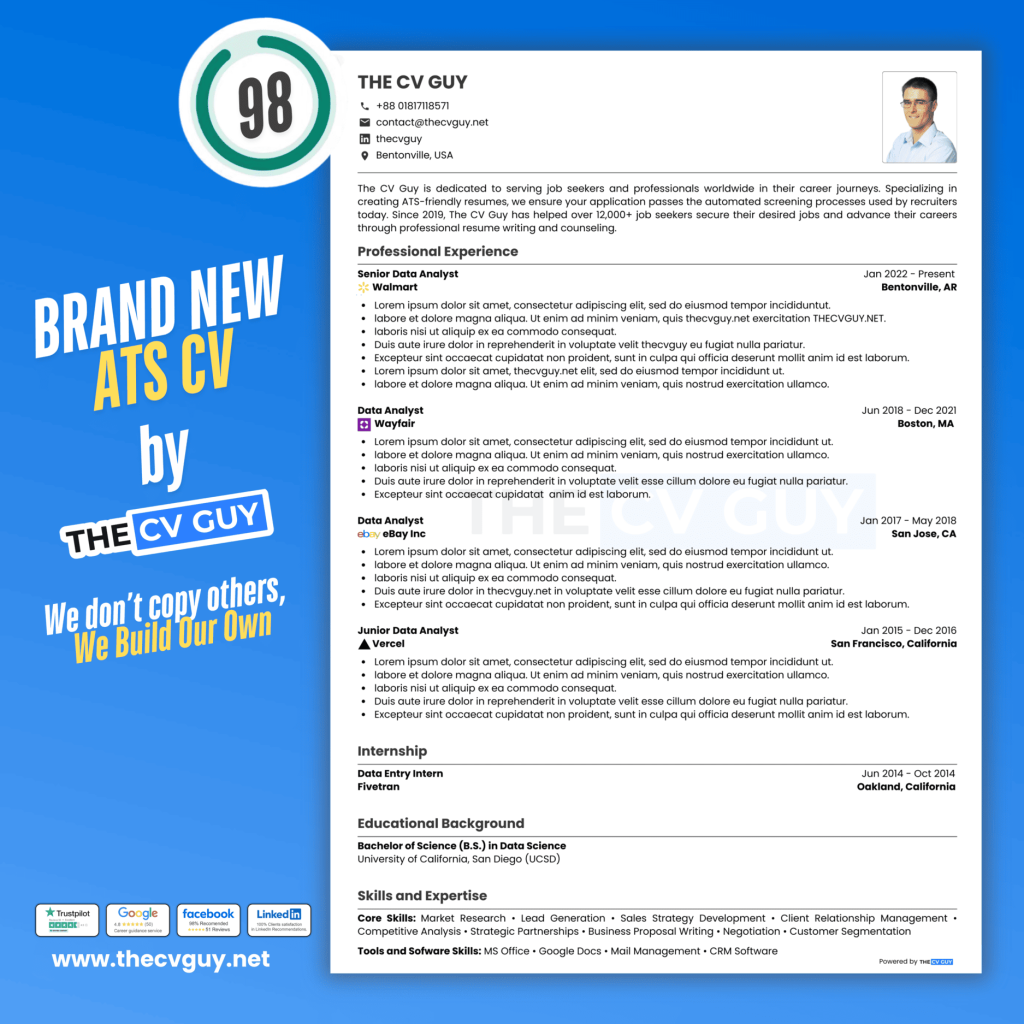

Getting noticed in today’s job market is tough. Even with the right skills, many candidates never make it past the initial screening phase. Why? Their CVs are either poorly structured, outdated, or simply not optimized for modern hiring systems.

Because, Recruiters at top banks often use Applicant Tracking Systems (ATS) to filter applications. These systems are designed to screen out resumes that don’t follow specific formatting or keyword rules.

If you’re serious about taking your banking career to the next level, don’t let your CV hold you back. These Standard Chartered roles don’t open up every day, and competition will be stiff. Give yourself the best possible chance by pairing your skills with a professional, modern CV that works for you — not against you.

Ready to apply? Let’s make sure your CV is interview-ready.